We Provide Ethical, Pro-Consumer Mortgage Services and Education Nationwide

Who Are We ?

Since 1993, ArcLoan has educated consumers across the United States on mortgage strategies and programs.

Our goal is simple - to help you gain access to pro-consumer, ethical, experienced mortgage specialists to HELP YOU, not sell you, when you are purchasing or refinancing. We will help you take advantage of interest rate cycles and mortgage management techniques to help increase savings and reduce debt.

Our Mortgage Management Strategies™ have been endorsed by national consumer advocates, financial planners, accountants, insurance professionals, attorneys and, more importantly, homeowners.

Our professional Mortgage Educators are ready to provide you with a No Obligation mortgage analysis which could save you thousands of dollars, or to assist you in purchasing a new home.

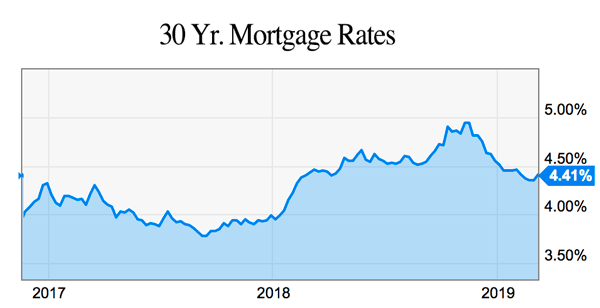

Rate Perspective

Our Mission Statement:

To provide both homeowners and potential homeowners throughout the United States with financial education strategies which enable them to take advantage of interest rate cycles, and mortgage management techniques to help them increase savings and reduce debt.

As a pro-consumer organization, our business model is relationship based, not transactional. Our philosophy is simple: Keeping Customer Loyalty By Earning It!

Our corporate culture was built around Integrity, Reliability and Credibility, which are rare attributes in the mortgage industry. We are proud to have helped consumers across the United States for over 25 years.

Our expert client services capabilities, coupled with our ability to offer sound, educational advice has resulted in a 90% client retention rate.

Learn more - MoneyAnswers TV Interview with ArcLoan

Purchasing

Purchasing is both an exciting and stressful experience for many people. Choose ethical and experienced mortgage specialists who know how to make the financing portion as stress-free as possible.

GET PRE-APPROVED before you shop!

Refinancing

Lowering your rate, consolidating debt, changing the term of your loan, etc. There are many reasons, and many programs for refinancing.

Choose to consult with experienced mortgage specialists who will focus on helping you, not selling you.